Why a Secured Credit Card Singapore Is Vital for Building Your Credit Rating

Why a Secured Credit Card Singapore Is Vital for Building Your Credit Rating

Blog Article

Unveiling the Possibility: Can People Discharged From Personal Bankruptcy Acquire Credit Report Cards?

Comprehending the Effect of Insolvency

Insolvency can have a profound effect on one's credit score, making it testing to gain access to credit history or car loans in the future. This monetary discolor can linger on credit history records for numerous years, affecting the individual's capacity to protect desirable interest rates or monetary chances.

In addition, bankruptcy can limit job opportunity, as some employers conduct credit checks as part of the employing procedure. This can posture a barrier to individuals seeking new task potential customers or occupation innovations. Overall, the impact of bankruptcy prolongs beyond monetary restrictions, affecting different aspects of a person's life.

Elements Impacting Credit Card Approval

Complying with insolvency, people often have a low credit history rating due to the adverse effect of the insolvency filing. Credit score card business typically look for a credit report score that demonstrates the candidate's capability to take care of credit history sensibly. By carefully thinking about these factors and taking steps to reconstruct credit score post-bankruptcy, people can improve their potential customers of acquiring a credit rating card and functioning in the direction of economic recovery.

Actions to Restore Credit After Insolvency

Rebuilding credit rating after personal bankruptcy calls for a strategic approach focused on monetary technique and consistent financial obligation monitoring. The very first step is to assess your credit history record to guarantee all financial debts consisted of in the bankruptcy are precisely shown. It is essential to establish a budget that prioritizes financial debt repayment and living within your methods. One effective method is to get a protected charge card, where you transfer a specific quantity as collateral to establish a credit line. Prompt repayments on this card can show liable debt use to potential lending institutions. Furthermore, think about coming to be an accredited customer on a member of the family's bank card or checking out credit-builder lendings to further improve your credit report score. It is critical to make all payments on time, as payment background significantly affects your credit rating. Perseverance and perseverance are key as restoring credit requires time, but with devotion to appear monetary methods, it is feasible to improve your credit reliability post-bankruptcy.

Safe Vs. Unsecured Credit Scores Cards

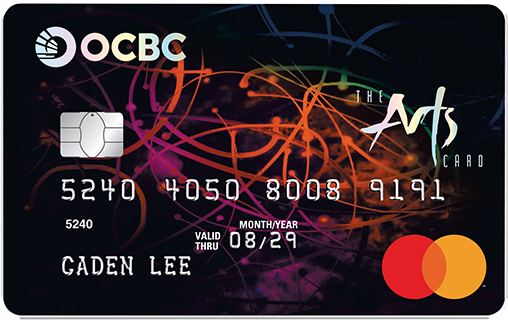

Following personal bankruptcy, individuals usually think about the selection between protected and unprotected credit history cards as they intend to rebuild find more info their creditworthiness and economic security. Protected credit scores cards need a money deposit that serves as collateral, generally equal to the credit report restriction approved. These cards are less complicated to acquire post-bankruptcy because the down payment minimizes the danger for the company. Nevertheless, they might have greater fees and rate of interest rates compared to unprotected cards. On the various other hand, unsafe debt cards do not require a deposit however are more difficult to certify for after personal bankruptcy. Issuers evaluate the applicant's credit reliability and may provide lower fees and rates of interest for those with a good monetary standing. When choosing between both, individuals ought to evaluate the advantages of easier approval with secured cards against the possible costs, and think about unsafe cards you can try these out for their long-lasting financial goals, as they can aid rebuild credit rating without locking up funds in a down payment. Eventually, the option in between protected and unsecured charge card must align with the person's monetary goals and capacity to handle credit report sensibly.

Resources for Individuals Looking For Credit Score Reconstructing

One important source for people looking for credit score rebuilding is credit report therapy firms. By functioning with a credit rating counselor, individuals can get insights into their credit report records, find out strategies to increase their credit ratings, and get assistance on managing their funds effectively.

Another practical resource is debt tracking services. These services permit individuals to keep a close eye on their credit score reports, track any kind of modifications or errors, and spot possible indications of identity burglary. By monitoring their credit report regularly, individuals can proactively attend to any issues that might guarantee and occur that their debt details depends on day and exact.

In addition, online devices and resources such as credit report simulators, budgeting applications, and financial literacy websites can offer people with beneficial info and tools to aid them in their debt rebuilding trip. secured credit card singapore. By leveraging these resources successfully, people discharged from bankruptcy can take purposeful steps towards boosting their credit health and wellness and protecting a better financial future

Verdict

To conclude, people discharged from personal bankruptcy might have the possibility to get credit rating cards by taking actions to restore their credit score. Variables such as debt debt-to-income, history, and revenue proportion play a significant function in charge card authorization. By recognizing the Visit This Link effect of bankruptcy, picking between protected and unsafe credit rating cards, and using sources for credit rebuilding, people can enhance their credit reliability and possibly acquire accessibility to charge card.

By functioning with a credit report counselor, people can get understandings into their credit scores reports, find out methods to increase their credit rating ratings, and obtain guidance on handling their funds properly. - secured credit card singapore

Report this page